Some Known Factual Statements About Lamina Loans

Table of ContentsHow Lamina Loans can Save You Time, Stress, and Money.The Greatest Guide To Lamina LoansThe Single Strategy To Use For Lamina LoansThe 20-Second Trick For Lamina LoansSome Known Details About Lamina Loans

However if you're seeking a lasting funding (like over the program of the next years), a variable rate of interest financing could not be best. When you apply for a financing, you normally need a good credit history and earnings to confirm you're a trusted prospect for a financing. If you don't have a strong credit report, you could need to discover a person else who does.A cosigner is someone that can vouch for your creditworthiness. A cosigner's credit report can protect you a funding when you wouldn't otherwise certify. Whether you require a cosigner to qualify or not, obtaining one can protect you a reduced rates of interest if they have far better credit than you. While paying your lending on schedule can increase your credit score (and theirs), not paying it back promptly can cause your credit score and also theirs to drop.

Compare rates from several loan providers in 2 minutes Concerning the author Dori Zinn Dori Zinn is a trainee finance authority as well as a factor to Reliable. Her job has actually shown up in Huffington Message, Bankate, Inc, Quartz, and also much more.

A (Lock A locked padlock) or implies you've safely linked to the. gov internet site. Share delicate information just on authorities, secure sites.

The Definitive Guide for Lamina Loans

A funding is when an amount of cash is provided to one more celebration or individual, generally including rate of interest as well as other fees, for the future payment of the finance. When the customer handles the funding, they concur to a collection of terms that might consist of rate of interest, financing costs, along with payment days.

Fundings are a kind of financial debt, and lending institutions will assess your credit reliability, typically consisting of aspects such as your credit report and records, prior to offering you a finance with its connected car loan terms, including rates of interest. The much better your credit rating, the more probable you'll be provided a loan with far better terms.

Introductory information concerning the various sorts of plastic cards available, covering debt cards, shop cards as well as credit card, and also prepayment cards. Lamina Loans. Information concerning just how hire acquisition and conditional sale arrangements function, the right to finish a hire acquisition contract as well as what happens if the purchaser is unable to pay. Points you can do to help manage or repay your overdraft account.

Covers credit scores brokers and also the charges made for their solutions. Information about acquiring things from a brochure and being a representative for a catalogue business. Details concerning what a pawnbroker is and also what happens if you are not able to repay your loan, lose your ticket or do not collect the goods.

The 2-Minute Rule for Lamina Loans

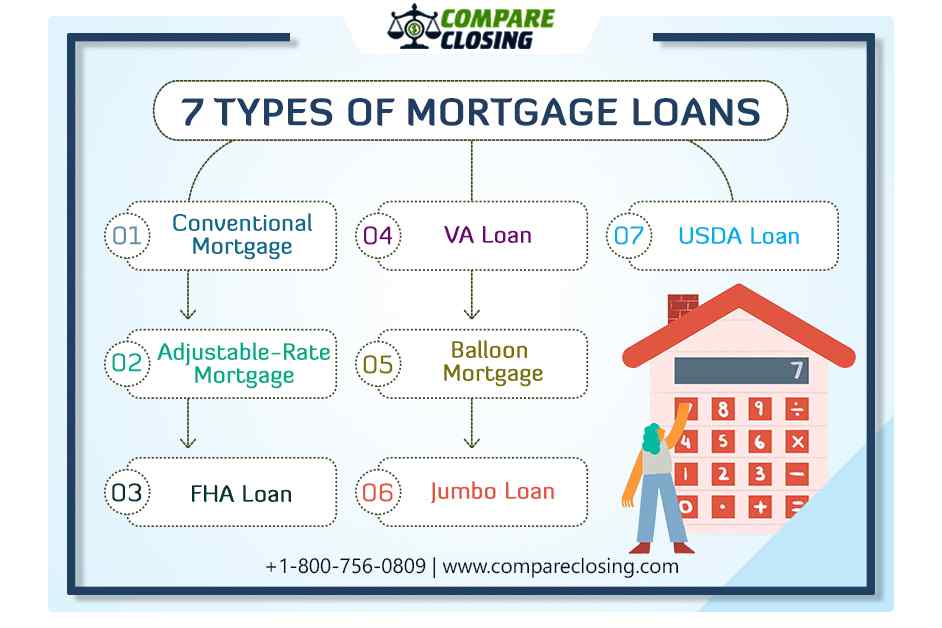

ARM car loans are usually named by the size of time the rates of interest remains set and how usually the rate of interest price is subject to change after that. For example, in a 5y/6m ARM, the 5y represents a first 5-year period throughout which the rate of interest rate remains repaired while the 6m shows that the rates of interest is subject to adjustment as soon as every 6 months thereafter.

These finances often tend to enable a reduced down payment and credit rating when compared to standard loans.FHA finances are government-insured loans that can be a good suitable for property buyers with limited revenue and also funds for a deposit. Financial Institution of America (an FHA-approved loan provider) offers these loans, which are guaranteed by the FHA.

Lamina Loans Can Be Fun For Anyone

Peer-to-peer (P2P) lending works by matching debtors with lenders via P2P borrowing systems. These systems function like marketplaces bringing with each other people or businesses that want to lend money, with those that desire a funding. Depending on the system, you may not have the very same security as when you obtain in various other means.

A term loan is simply a funding offered service objectives that requires to be paid back within a defined timespan. It usually carries a set rate of interest, month-to-month or quarterly settlement schedule - as well as consists of an established maturation date. Term financings can be both protect (i. e. some security is supplied) and also unsecured.

An over-limit center is considered as a source of short-term financing as Homepage it can be covered with the next down payment. Lamina Loans. A letter of credit is a paper provided by a banks ensuring settlement to a seller supplied certain documents have been provided to the financial institution. This makes sure the repayment will certainly be made as long as the solutions are executed (normally the send off of products).

The Buzz on Lamina Loans

At the verdict of the leasing duration, the lessor would have recovered a large section (or all) of the initial price of the determined property, in enhancement to passion earned from the services or installments paid by the lessee. The lessee likewise has the alternative to obtain ownership of the identified possession by, as an example, paying the final service or installation, or by negotiating a final acquisition price with the lessor.

Nonetheless, the lessee has control over the asset, and takes advantage of it as needed. This is normally a company lending used to SMEs and are collateral-free or without 3rd party assurance. Right here the borrower is not called for to supply collateral to obtain the funding. It is offered to SMEs in both the start-up in addition to existing phases to offer functioning capital needs, acquisition of equipments, sustain development plans.

This loan facility is offered try this to companies with greater than two years of company experience, existing proprietors of at the very least 2 industrial automobiles, captive clients and also carriers (Lamina Loans). It is necessary to note that these are just basic summaries. Lenders have their specific lending evaluation and documentation criteria before a loaning decision is taken.